Ch 3.10 | 💳Capitalism and monetary policy

I am a capitalist. I don’t want anyone reading this to think otherwise.

Anselme Polycarpe Batbie (a 19th century academic jurist) said:

He who is not a républicain at twenty compels one to doubt the generosity of his heart; but he who, after thirty, persists, compels one to doubt the soundness of his mind.

I believed this for most of my business career. But I also believe that unbridled capitalism, unchecked by a sense of the larger role that capitalism plays in our society, is a flawed approach.

It is my strong belief that capitalism, at least in its current incarnation in America, does not advance the public interest. But let’s be clear: I strongly disagree with Rep. Jamaal Bowman, who said,

I believe our current system of capitalism is slavery by another name.

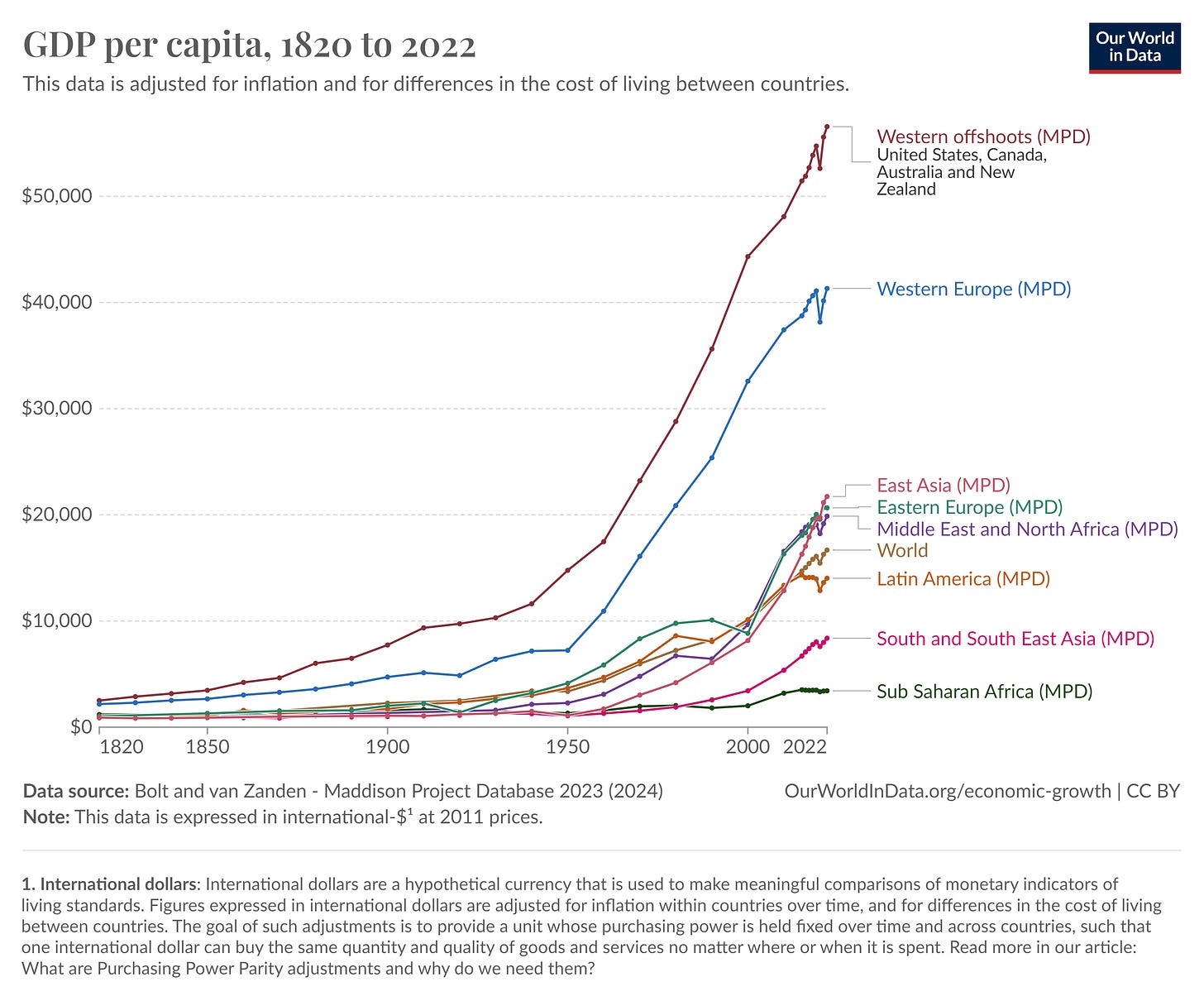

Even with all its flaws, capitalism and pseudo free market economies have given more prosperity and more hope to more people than any other system invented to date.

It's actually political dysfunction that is the greatest threat to our economic prosperity!

In this paper by Brookings Senior Fellow William Galston, he summarizes the two principal sources of dysfunction in the economic policy process and describes in more detail many of the bipartisan recommendations for improvement. On of the poignant things he states upfront is that:

Recognizing that the current level of political polarization will make it difficult for even the best new rules to succeed, proposals have been advanced to tackle a key underlying cause of excessive partisanship, the structure of the U.S. elections process. Election reform would undoubtedly be slow and difficult; however, the most promising reform options would encourage states to:

Adopt non-partisan systems for congressional redistricting and institute more “open primaries,” in which independent voters as well as registered party members can participate.

Adopt innovative voting systems, such as instant runoff voting, in order to give candidates incentives to reach beyond their current base.

Expand the electorate through various means, in order to bring less committed swing voters into the process.

Consider if there should be limits/bounds on where the profit motive should be the driving force. For example, should we have for-profit prisons? For-profit schools? For-profit militias? For-profit insurance companies? For-profit health care? Is there any area where the profit motive has been demonstrated to create “moral hazard” and/or create a misalignment that does more harm than good to society as a whole?

Don't want to believe me? Here's what hedge fund manager Ray Dalio had to say about it:

There is only one path that will succeed in preventing civil war and promote working well together to make real improvements and that is to have a very strong middle. This strong middle would consist of bipartisans who are bound together to beat the extremists and then go on to reform the system and deal with our structural problems — i.e., to reform the system to work well for most people by creating broad-based capabilities, productivity, and prosperity. While I have lots of ideas about how to do this, my ideas are not that important now (or, maybe ever) relative to the need for these bipartisan reforms to happen one way or another.

Income inequality

If we want to avoid government overreach into business, we need to start talking about income inequality.

Throughout the annals of human history, a pronounced gap has consistently existed between the affluent elite and the toiling masses. This socio-economic schism has manifested in myriad forms across diverse cultures and epochs. Typically, perched atop this hierarchy were monarchs, pharaohs, emperors and feudal lords ensconced within their fortified citadels, in stark juxtaposition to the overwhelming majority of their subjects, often comprising slaves or serfs, who endured ceaseless labor for their survival and the sustenance of the aristocracy.

For instance, in the context of the Roman Empire, the institution of slavery assumed a central role in societal structure, with an estimated 40% of Italy's population enduring enslavement under arduous conditions, primarily serving the interests of the opulent elite.

Centuries later, during the medieval period in Europe, pervasive inequality persisted under the feudal system. Here, the nobility and lords laid claim to extensive swaths of land and reveled in opulent lifestyles within their formidable castles. In stark contrast, the serfs found themselves bound to the land, often subjected to relentless toil seven days a week. Research findings indicate that the serfs, constituting over 90% of the population, retained ownership of a mere 15% of the land — a testament to the glaring wealth disparity.

Even in the contemporary landscape, when we gauge wealth in terms of tangible assets and purchasing power, this disparity continues to loom large. The situation becomes even more stark when we consider income alone. As of 2023, the poorest half of the global populace commands a mere 2% of the total wealth, while the richest 10% of the global population lays claim to an astonishing 76% of all available wealth. These figures starkly illustrate the extent of the divide, which, on its face, appears both substantial and challenging to address.

Looking at the United States in particular, the wealth and income divide has fluctuated over time. There are a few key periods in U.S. history that are often highlighted as times when income inequality was relatively lower and the middle class experienced significant prosperity — most notably, the post-World War II era from the 1940s until the 1970s.

The period following the war, often referred to as the "Golden Age of Capitalism" or the "Postwar Boom," saw a significant reduction in income inequality in the United States. Government policies, including high marginal tax rates on the wealthy and strong labor unions, contributed to a more equitable distribution of wealth. The GI bill provided education and housing benefits to veterans, helping many working-class individuals access higher education and homeownership. Economic growth was robust, and a growing middle class enjoyed rising wages, job security and increased homeownership.

During the 1950s and 1960s, income inequality was relatively low, and the middle class expanded. Economic policies, such as the minimum wage, played a role in lifting many Americans out of poverty. Union membership was high, giving workers bargaining power for better wages and benefits. The overall prosperity was also fueled by a booming manufacturing sector.

Income inequality has consistently increased since the late 1970s, and the middle class has faced challenges in recent decades. Various factors, including globalization, technological changes and shifts in labor markets, have contributed to these trends.

And don't kid yourself — income inequality is a serious threat to our country's unity and stability.

The gap between the richest and poorest Americans has been growing for several decades. Unfortunately, because dysfunction plagues government, policymakers are unable to address income inequality and support middle-class prosperity in the modern era.

Do you know that almost half of all Americans are in low-wage jobs paying median annual wages of $18,000 and most middle-class Americans can't support their cost of living? Our cities are too expensive and increasingly dangerous, while the suburbs are out of reach for many. If history has taught us anything, it is that when great wealth is concentrated in the hands of an “elite” few, revolution and civil war often follow.

In his 2017 commentary titled "Our Miserable 21st Century," Nicholas Eberstadt noted:

If 21st-century America’s GDP trends have been disappointing, labor-force trends have been utterly dismal. Work rates have fallen off a cliff since the year 2000 and are at their lowest levels in decades. We can see this by looking at the estimates by the Bureau of Labor Statistics (BLS) for the civilian employment rate, the jobs-to-population ratio for adult civilian men and women. Between early 2000 and late 2016, America’s overall work rate for Americans age 20 and older underwent a drastic decline. It plunged by almost 5 percentage points (from 64.6 to 59.7). Unless you are a labor economist, you may not appreciate just how severe a falloff in employment such numbers attest to. Postwar America never experienced anything comparable.

Meanwhile, over the past 50 years, corporate profits have risen by 185% while wages rose by only 1%. If we want to know why the average person in America is angry, look no further than this: In 2021, it was estimated that the CEO-to-worker compensation ratio was 398.8 in the United States. This indicates that, on average, CEOs received nearly 400 times the average annual salary of production and nonsupervisory workers in the key industry of their firm.

According to Boston University professor David Webber, writing in his book "The Rise of the Working-Class Shareholder: Labor's Last Best Weapon," that rate is

more than double the next two highest countries, Switzerland and Germany, at 148 and 147 times respectively. CEOs in Australia, the United Kingdom, and Japan are paid, respectively, 93, 84, and 67 times what the average worker is paid.

He further notes:

U.S. CEOs weren’t always so exorbitantly paid relative to their employees. According to the Economic Policy Institute, in 1965, CEOs of the largest U.S. firms were paid 20 times their workers.

In his book, Webber uses cases such as Safeway's labor dispute in 2003 to shine a light on how corporate interests, represented by folks like the Koch brothers, Exxon Mobil, and the Olin and Scaife families, are working to defund pensions in order to prevent pension trustees' from using the power of their investments to hold corporations and their boards accountable and fighting for meaningful corporate elections that provide shareholders with proxy ballot access (the corporate equivalent of the closed primary in our election system) and outrageous CEO pay. The book is a must read. It is chock full of examples of corporate hubris that pits management and boards against their workers and the pension funds that represent them.

In 2023, Isaac Saul reflected on Labor Day in "A Pivotal Moment for U.S. Workers." As always, he examined the issue from all sides with transparency.

And to ground this in monetary policy, if we want to prevent the federal government from deciding how to "redistribute" wealth in the U.S., then corporate America needs to lead. In his book “The Great Game of Business”, Jack Stack, wrote about taking responsibility for our nation’s problems:

Too many businesses have forgotten that they are here to create jobs. That’s how they add value to an economy, a society, a nation. …

The motivation has to come from inside. That applies to bosses as well as workers. Whether you’re the president of General Motors, or the operator of a fast-food franchise, or a middle manager in a multinational company with a traditional approach to business, you gotta wanna change. The biggest obstacle does not lie in the boardroom or in the corner office, but in ourselves. …

We’re at the end of innocence. There is no one who can solve these problems for us. We’ve run out of cheap sources of funds. We can’t pay for solutions by taxing the rich: they don’t have enough money. If we tax business, we’re just buying a new, worse set of problems and aggravating the ones we already have. We can’t borrow: the Japanese and the Europeans have tightened up on credit. Besides, even governments have to pay their debts sooner or later. To do that, you need cash, and there are only three ways to get it: (1) you can print money — and further undermine the economy through inflation; (2) you can sell off assets — and give up ownership of your national resources to foreigners; and (3) you can get the country focused on making money and generating cash. In fact, making money and generating cash offers the only real hope we have of solving the problems we face as a society. The alternatives are not solutions at all. They are just ways of managing the decline of our economy, our standard of living, and the opportunities for our children, our grandchildren, and generations beyond. What’s required is a new way of thinking and a vast program of education. By and large, that education has to be carried out in the businesses of America—on the shop floors, in the warehouses, behind the retail counters, over the water coolers and the copying machines, at the desks, in the meeting rooms and the cafeterias. We have to change the entire mentality of the country, a mentality we have created by the way we have run companies in the past. We have to get rid of the excuses. We have to uproot the idea that you can always blame somebody else for your problems and always look to somebody else to take care of you. All of us have to take responsibility for ourselves. We have to become self-reliant. We have to get into benchmarking, meeting the standards, watching costs, being held accountable, establishing goals, compensating with bonus programs, using the multiple, and teaching people to think and act like owners — we have to do it all, because it’s the only chance we have of getting our economy and our society back on track. But it won’t happen unless management leads the way.

Like it or not, the responsibility for the future rests squarely on the shoulders of the people who run America’s businesses. We are the only ones left with the credibility and the clout to bring about real change. This is nothing to cheer about. We all need balance in our lives, and our society would benefit from more balance as well... As it is, the leadership has to come from business. If you want to see one of the people we’re counting on to turn things around, look in the mirror. As businesspeople, we need to get back to basics. We need to refocus on our primary social mission: creating jobs. When you create jobs, you are creating the means for absorbing overhead, including all that social overhead we have accumulated. The fewer jobs we create, the more people there are on unemployment or welfare, without health insurance, getting caught up in poverty and crime.”

Couldn’t have said it better myself! If we want to see a return to less government oversight of our economic engine, then corporate America needs to take ownership and be the change that is needed.

The political narrative on inflation

If you buy into the GOP narrative, then you already blame the Biden administration for the current inflationary environment. But did Biden and his policies cause this inflation? Or is it the result of failed economic policies that have been implemented by the duopoly over the past 100 years? More on that later.

Throughout 2022, the GOP has cited the $1.9 trillion American Rescue Plan Act of 2021 as the main culprit of our current economic climate. But that ignores the impact of Covid and the Trump administration's actions/inactions during the pandemic.

But is the American Rescue Plan truly the main culprit or is that political theater? Well… Let’s look around the world in 2022. Did the legislation cause Mexico’s inflation to reach 8.7%? Italy and Spain’s 8.9%; the Eurozone’s 9.9%? Germany’s 10%? The U.K.’s 10.1%? Russia at 13.7%? The Netherlands at 14.5%? What about Argentina and Turkey at 83+%?

Certainly not.

So, what is the cause of inflation?

The printing of money plays a huge part but it’s actually the central banks’ fractional reserve policies that are the main contributing factor. Of course, it's not the sole answer to the question. The pandemic has been a major factor in near-term monetary policy. The federal government decided to inject trillions of dollars of pandemic aid into the economy. There is a very basic, traditional economic argument about that decision. Steve Hanke and Kevin Dowd put it like this:

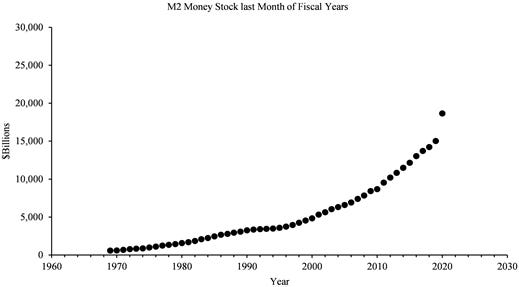

Since February 2020, the Fed has flooded the “monetary bathtub” by increasing the M2 money supply by a cumulative 41 percent. Money has been flowing into the bathtub much faster than it is draining out of either the real GDP “drain” or the money-demand “drain.” When more money flows into the bathtub than drains out, money “overflows” as inflation.

When too many dollars begin chasing too few goods, prices go up. This is Economics 101 stuff.

And while the U.S. has outsized influence on the world’s economy, inflation is a global phenomenon and is impacted by the central banks around the globe. If you don’t understand the insidious causes of inflation, then of course the public is going to blame Biden because it’s what they’re told to do.

But, as I discuss later, inflation has been a constant under almost every administration over the last 100 years. The challenge is that once you conclude that inflation is caused by the printing of money, which it is, it’s how corporations and governments react to the increase in monetary supply that ultimately creates price inflation.

If you zoom out you see that it’s a result of many factors including supply chain issues still resulting from Trump’s handling of the pandemic and Biden’s reaction to it upon taking office. More recently, the Russian invasion of Ukraine, surging demand, production costs, and swaths of relief funds all have played a role.

And let’s not forget corporate greed in many sectors, including oil and gas. Here's a interesting excerpt a House Oversight Committee meeting in September 2022 where Rep. Katie Porter from Orange County, Calif., cites data from the Economic Policy Institute:

This is illustrative of several points I've been making. First, it demonstrates how unbridled corporate greed absent any concern for the impact it's having on society as a whole needs to be addressed. But it also demonstrates how the GOP's narrative around inflation continues to put the needs of corporations ahead of the needs of our country. Have you observed that corporate profits have risen well above what we would expect from inflation? In fact, corporate profits now account for 54% of companies’ growth. Profit margins are at highest level since 1950s. How can you explain that? As Axios's Emily Peck reported, the once fringe theory of “greedflation” — which was largely perpetuated by progressive economists and pundits — has started picking up mainstream traction. Lael Brainard, who was at that time the vice chair of the Federal Reserve, said in January 2023 that:

a "price-price spiral" was responsible for inflation.

Paul Donovan, the chief economist at UBS Global Wealth Management, said:

"profit margin-led inflation" was driving price increases, and that retailers and consumer goods makers were lying to consumers about the need to raise prices.

There are some notable distinctions here. Donovan, for instance, was not necessarily supporting the idea that corporate greed was driving inflation. Instead, he described a scenario where companies that usually don't have much pricing power saw an opportunity to increase prices and at a time when customers might accept those increases. In other words: Customers had the money, and corporations had the excuse. Donovan has rejected the term greedflation, instead arguing that companies simply took advantage of an opportunity to raise prices more than normal — an opportunity that was created only by a once-in-a-lifetime pandemic.

It's hard to overstate the implications of this. If corporations are driving inflation, and not monetary policy, most Americans are getting the worst of all worlds. Interest rates are going up — meaning things like mortgages are getting more expensive — while prices of consumer goods go up, too. And those price hikes hit middle and lower class Americans the hardest. And the prescription to resolve them (raising interest rates) is also expected to drive up unemployment. So we're losing out in every direction, all while big greedy corporations cash in. Donovan and Brainard are far from alone in calling out this potential dynamic.

Another big scapegoat that I’ve heard my friends mention is the Keystone XL pipeline. They use this as an example of how Biden caused gas prices to spike and contributed to the inflation we are suffering through. Curious – did you do any research or did you rely upon the GOP sound bites? Please stop and read this article, which outlines the myths regarding high gas prices so you can find the facts and refute the lies. Moreover, oil companies are under enormous pressure from Wall Street to return cash to shareholders through dividends and buybacks, instead of investing in badly needed supply. According to a Federal Reserve Bank of Dallas survey released in March 2022, 59% of oil executives said investor pressure to maintain capital discipline is the primary reason publicly traded oil producers are restraining growth.

I would welcome any opposing views and the research to back it up! Just use the comments section to share your thoughts.

Inflation and money supply

A good place to start would be to watch Milton Freedman’s “Free to Choose.” The full program is over 10 hours and it’s fascinating but here’s a short excerpt regarding inflation and the printing of money. It’s a decent primer on the concepts underlying how inflation and the money supply correlate.

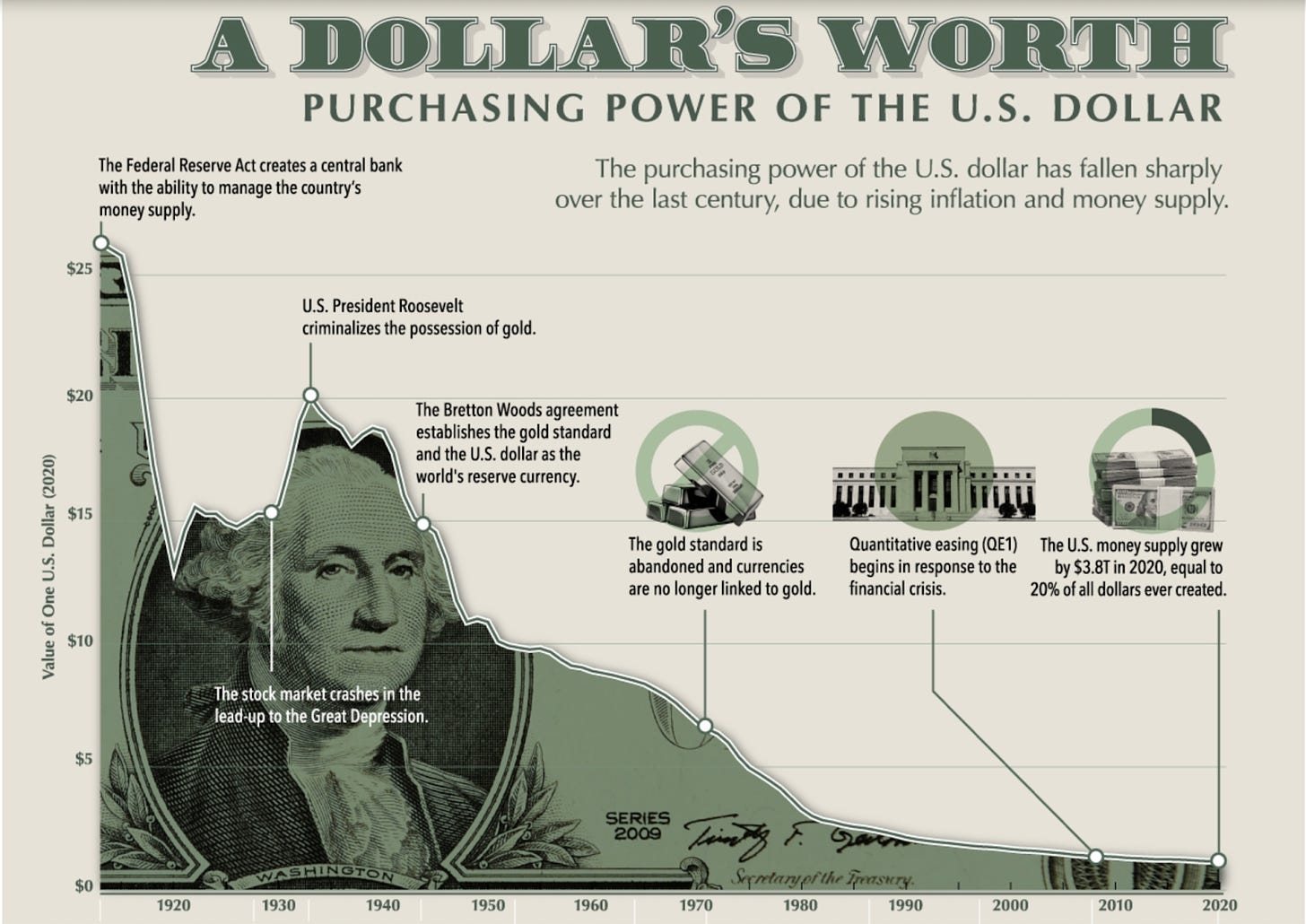

The dollar had been tied to a finite standard dating back to 1792. The dollar has survived multiple wars, armed conflicts short of war, economic recessions, and the Great Depression. From 1929 to 1933, the purchasing power of the dollar actually increased due to deflation and a 31% contraction in money supply before eventually declining again. Fast forward to 1944 and the U.S. dollar, fixed to gold at a rate of $35 per ounce, became the world’s reserve currency under the Bretton Woods agreement. Other currencies were fixed to the dollar and the dollar was in turn fixed to the gold standard.

Meanwhile, the U.S. increased its money supply in order to finance the deficits of World War II followed by the Korean war and the Vietnam war. Hence, the buying power of the dollar reduced from 20 bottles of Coca-Cola in 1944 to a drive-in movie ticket in 1964.

By the late 1960s, the number of dollars in circulation was too high to be backed by U.S. gold reserves. President Richard Nixon ceased direct convertibility of U.S. dollars to gold in 1971 ending both the gold standard and the limit on the amount of currency that could be printed. Since that time, the United States money supply, national debt, and stock market indices have experienced exponential growth.

In his book, “The History of Money,” Jack Weatherford measured the dollar against the price of gold to illustrate the declining value of the dollar, pointing out that

the dollar has undergone a nearly constant decline in value when measured against gold …a home, a car, or any basket of goods.

By the end of the year 2020, the dollar had become nearly worthless when measured against gold.

In “The M2 Money Supply, the Economy, and the National Debt: A Mathematical Approach,” the authors’ data collection revealed that following the change in economic policy in 1971, the total national debt soared from approximately $398 billion in 1971 to roughly $27 trillion at the end of fiscal year 2020. During this period, the Dow Jones Industrial Average increased from 887.2 points to 27,781.7 points. The M2 (a measure of the total supply of money) also expanded from $692.5 billion to $18.6 trillion. During this era, at no time did the national debt or the M2 decrease from the end of one fiscal year to the end of the next. However, the Dow has fluctuated wildly at times. The largest relative annual increase in the Dow occurred between the end of fiscal year 1986 and the end of fiscal year 1987 when the Dow gained 46.9%. The largest relative annual decrease came between the end of the fiscal year 1972 and the end of the fiscal year 1973, when the Dow decreased by 35.8%.

My question is twofold:

Can we continue to print money indefinitely without consequence?

How do we reverse course without collapsing not only the U.S. economy but the global economy?

Monetary and fiscal policy

Sixty years ago, President Dwight Eisenhower said in his farewell speech said:

We, you and I, and our government — must avoid the impulse to live only for today, plundering, for our own ease and convenience, the precious resources of tomorrow. We want democracy to survive for all generations to come, not to become the insolvent phantom of tomorrow.

As Oren Cass, executive director of the conservative think tank American Compass, states:

American industry lost its technological edge, from semiconductors to commercial aerospace to robotics. Investment stalled, so much so that the entire corporate sector became a net lender, handing money back to financial markets faster than it tapped those markets for capital to invest.

As American Affairs editor Julius Krein has observed:

[I]f $1 trillion in annual stock buybacks are to be taken at face value and there are in fact no better investments to be made … it calls into question the viability of the free market capitalist system itself.

That said, America is still an incredibly powerful economic force! I don't want to lose sight of that. My intent here is not to be a pessimist or to be Chicken Little, claiming the sky is falling.

In fact, in Merrill Lynch’s July 2023 Capital Market Outlook, "Market View — Still On Top: Debunking the Myth of America’s Decline," Managing Director Joseph Quinlan and Senior Investment Strategist Lauren state:

Distracted by divisive politics and a 24/7 negative news cycle, many investors have been blinded to the underlying strengths of the U.S. economy and bought into the narrative that America is in secular decline, and that global growth, consumption and earnings are shifting elsewhere, notably East, to China. However, evidence of this global shift isn’t as compelling and cogent as the consensus suggestions. We are well into the 21st century, and America remains one of the most competitive and resilient economies in the world. As we discuss, the U.S. is a hydra-headed superpower—or an extraordinary economy that does a number of extraordinary things very well.

With just 4.25% of the world’s total population, America accounted for roughly 25% of total world output in 2022, according to figures from the International Monetary Fund (IMF).

Amazingly, that’s the same percentage as 1980, meaning the U.S. economy has held its own—and then some—in the face of major seismic events of the past forty years. Betting against the U.S. has been costly for investors. Indeed, U.S. Equities have handily outperformed other global indexes over the past decade, as we highlight in this report.

All that said, blind optimism can lead to complacency. I prefer to subscribe to the belief that if you're not moving forward and evolving you are moving backwards.

Also, I do believe we should always remember that the information we are consuming is biased. The information cited above after all was from Bank of America, which has a vested interest in continuing to foster trust in the capital markets.

My pessimism about the state of our economic affairs is due to our unsustainable levels of debt combined with our government’s inability to show any modicum of fiscal responsibility while devaluing the U.S. dollar at an unprecedented rate. For as long as I can remember, we have politicized how we manage our finances. It has to stop!

This may sound like a contrarian point of view, but I believe our economy is being propped up by decades of unsustainable and short-sighted, irresponsible fiscal policies (on both sides of the aisle), which history has shown us always leads to the populace looking for someone to blame.

In August, 2023, Fitch downgraded the U.S. long-term credit rating to AA+ with a Stable outlook, from AAA with a Negative outlook. Fitch cited:

Expected fiscal deterioration over the next three years (6-7% deficits each year), a high government debt burden, and an erosion of governance seen in the repeated debt limit standoffs with last-minute resolutions.

Fitch had previously downgraded the U.S. credit outlook to Negative from Stable back in August 2020, citing a deterioration in public finances due to deficit spending. Moody’s currently has a AAA rating with Stable outlook. S&P currently has a AA+ rating with a Stable outlook.

Here's an interesting article published by Ray Dalio. In it he says:

The economy clearly isn’t reacting in the usual way to the Fed’s tightening; it is much stronger than normal and stronger than expected. Why is that?

It's a fascinating point of view that highlights the deteriorating balance sheet of the Federal Government.

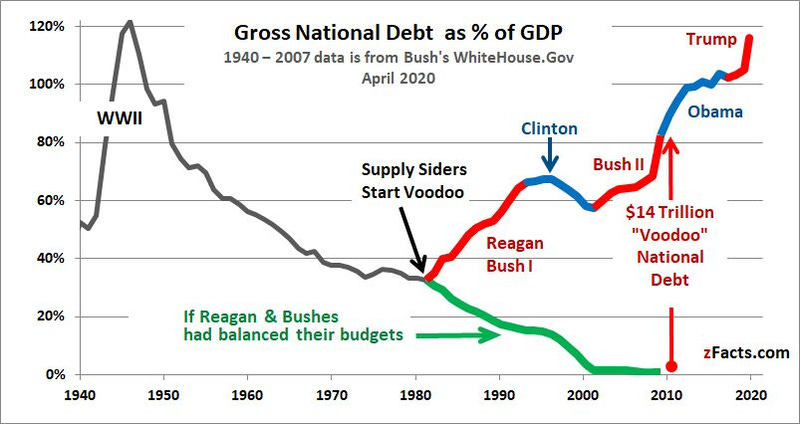

National debt

This is the single greatest existential threat we face as a country.

The federal government reports that we have more than $30 trillion in federal debt and it has been on an upward trajectory for many years. This trend accelerated with the spending required to address the Covid-19 pandemic. It's increased $10 trillion since 2008.

According to a 2011 research paper from the Bank of International Settlements titled, “The Real Effects of Debt,” when government debt exceeds 85% of GDP, it becomes a drag on economic growth. For several years, the nation’s debt has been bigger than its gross domestic product,and now sits at 121% of GDP which was $26.13 trillion in the fourth quarter of 2022. Public concern about federal spending is on the rise. In a Feb 2023 Pew Research Center survey about the public’s policy priorities, 57% of Americans cited reducing the budget deficit as a top priority for the president and Congress to address that year, up from 45% the prior year. Concern has risen among members of both parties, although Republicans and Republican-leaning independents are still far more likely than Democrats and Democratic leaners (71% vs. 44%) to view cutting the deficit as a leading priority.

Unfortunately, there is significant disagreement among economists and politicians about the urgency of reducing the national debt relative to other priorities. Moreover, there is continued debate about Social Security which is facing long-term funding problems. As the population ages and the ratio of workers to retirees decreases, there are concerns about the sustainability of the current system. While adjustments could be made to extend the solvency of the program, these are politically sensitive decisions that often face opposition.

Consider these charts from Scientific Research:

It’s incredible how our “prosperity” appears to be directly correlated to the money supply and the amount of debt we’ve incurred as a nation.

Just look at what has happened since Reagan.

He rode to office on complaints of an “out-of-control debt” that was as big as “a stack of $1,000 bills 67 miles high.” And in eight years in office he added another 125 miles to that stack!

But one influential Republican leader saw it coming and said so loud and clear.

His name was George H. W. Bush, the 41st president of the United States. You might recall that he called Reagan’s plan “voodoo economics”, and when it came to the debt, that voodoo made a zombie out of Reagan and generations of Republicans. Unfortunately Bush lost the primary to Reagan and was tapped to be vice president. So not long after he called voodoo on Reagan, he had to deny he ever said it. So, Bush sold out.

What is certain is that Bush was right!

“Reaganomics” was really just voodoo economics, with the inflationary impact of Reagan’s tax plan and the fact that it became the de facto standard of “conservative” politics. As you can see from the charts above, Bush was spot on and the impact of this fiscal irresponsibility has our country drowning in debt.

Unfortunately, I am not an economist, so I have no idea how to begin to propose solutions to this problem. My hope is that if we can fix the system and end the duopoly's control over the government, common sense solutions might emerge.

In fact, The Washington Post editorial board has a compelling, pragmatic and realistic plan that draws on ideas from the right and left to address the problem. It includes increasing the retirement age to keep up with rising life expectancy, broadening taxes to fund Social Security, and decreasing what high-income households get (while increasing what low-income households get). The board also lays out ideas on Medicare, farm subsidies, veterans care and the defense budget. Sensible ideas abound. Members of Congress formed the Bipartisan Fiscal Forum, aiming to take the partisanship out of some budget cutting.

While encouraging — and it is — I continue to believe Congress lacks the courage and political will given the dysfunction in our political system.

Before I leave this subject, I'm not sure that $34.6 trillion is in fact an accurate accounting of our national debt. We will discuss later that there are immense amounts of hidden foreign-exchange liabilities that may total to more than $65 trillion.

According to the National Review in, "The Biggest Issue that Few Presidential Candidates Want to Talk About":

The primary driver of the country’s spending deficit is entitlement programs, a fact that a lot of elected officials — and a wide swath of the American public — prefer to ignore. Social Security, Medicare, Medicaid, the Affordable Care Act, and other health-care programs consumed 46 percent of all federal spending. For perspective, all U.S. defense spending was 12 percent.

The U.S. spent roughly $877 billion on national defense in 2022. The U.S. federal budget deficit in fiscal year 2022 was $1.38 trillion. If the U.S. had a magic wand and hadn’t spent a single penny on defense that year, we still would have had a deficit of about $500 billion.

For a long, long time, fiscal conservatives — you know, those allegedly merciless tightwads who are always portrayed as pushing granny off a cliff — have warned the rest of the country that the finances for these programs are on an unsustainable path, and the rest of the country has hated them for it.

Every year, the Centers for Medicare & Medicaid Services review the numbers, and the most recent conclusion is, “The Medicare hospital insurance trust fund is scheduled to become insolvent in 2031. This means that in 2031 Medicare will be unable to pay for all promised benefits, and Medicare patients will face an initial 11 percent cut in their hospital benefits.”

These new numbers are actually a better outlook than the previous few years. (As I noted in February, “Go figure, it turns out that a terrible global pandemic that kills 1.1 million Americans, mostly the elderly and the sick, reduces the projected long-term expenditures for health-care and old-age benefits.”)

This doesn’t mean that Medicare would stop paying for senior citizens’ health care entirely in 2031, but the payments to hospitals would drop significantly, with the hospitals turning around and expecting patients to make up the difference. Medicare’s hospital insurance currently covers 100 percent of the hospital costs, after the $1,600 deductible, for 65 million elderly Americans. For the first 60 days in a hospital stay, Medicare patients pay nothing. For the next 30 days, they pay $400 per day.

By 2030, Medicare’s hospital insurance is projected to cover 76.8 million Americans.

As the 2024 presidential campaign ramps up, candidates are facing pressure to pledge not to touch Social Security. While this pledge is framed as ‘protecting benefits,’ it is — in reality — an implicit endorsement of a 23 percent across-the-board benefit cut in 2033, when the Social Security retirement fund becomes insolvent. In that year, annual benefits would be cut by $17,400 for a typical newly retired dual-income couple.

If we do nothing, Medicare and Social Security hit a brick wall at high speed in 2031 and 2033, respectively.

The dollar is the reserve currency of the world

As referenced earlier with respect to the national debt, “It’s the $65 Trillion in Debt You Can’t Find That’ll Get You.”

I will say that there is another equally important issue to consider. It seems to me that if our enemies want to destroy us, the surest way to do that would be to end the use of the U.S. dollar as the world’s reserve currency. Watch this video from April 2022 for a primer.

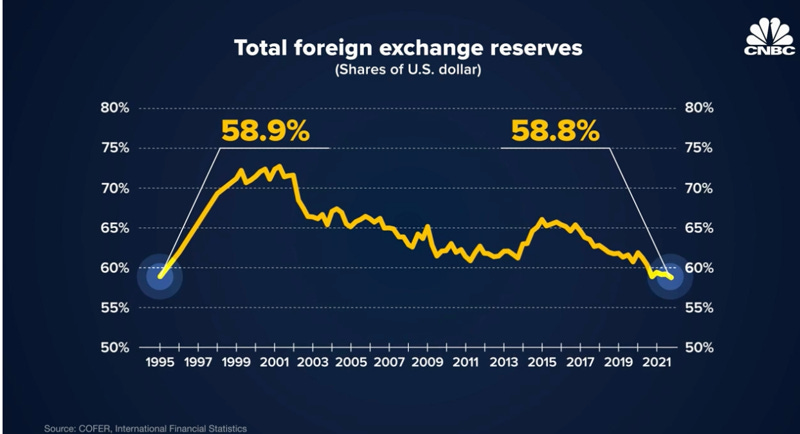

As discussed in the video, our share of the market has dropped to a 20 year low.

Benn Steil, senior fellow and director of international economics at the Council on Foreign Relations, said:

It's certainly not an imminent threat to the dominance of the dollar, but it's by far the biggest one.

Today the dollar accounts for around 60% of foreign exchange reserves, easily topping the euro's estimated 21% and dwarfing the Japanese yen (6%), the British pound sterling (4.7%) and other currencies in the single digits, according to the latest figures from the International Monetary Fund.

But the U.S. is not unmatched in all economic measures. China is on a fast track to becoming the world's largest economy, even as its currency comes in at only 2.25% of foreign exchange reserves. Coinciding with Beijing's rise is an onslaught of new sanctions from Washington targeting the People's Republic for a laundry list of alleged human rights abuses.

More from Newsweek:

We often choose to mistake other countries' pain for achieving our aim," Benn Steil said. "In other words, when we impose financial sanctions on other countries, it's usually to change their foreign policy. But in the vast majority of cases they don't actually do that." The pain is felt mostly by civilian populations, especially in blacklisted countries like Cuba, Iran, North Korea, Syria and Venezuela. Though sanctions have won political points at home for U.S. administrations, this is little evidence that the targeted countries shifted or abandoned undesirable policies of governments in response to the economic coercion. Instead, the U.S. has seen leading strategic competitors China and Russia, and even allies and partners like Turkey and India, increasingly swing their economic weight in the direction of trading in their respective national currencies when it suits their interests. The dollar remains on top, but countries are beginning to question the degree to which U.S. financial institutions serve as intermediaries—or gatekeepers—for international banking

And it’s not only foreign policy and sanctions such as the ones we are imposing upon Russia and China today. A debate raged in financial markets about whether the seizing of Russia’s foreign exchange reserves signaled the end of the U.S. dollar as the world’s reserve currency. The Financial Times reported:

[T]he Chinese central bank and finance ministry held an internal conference discussing how to protect against potential US seizures of foreign currency reserves.

Around the same time, leading Communist Party intellectuals were discussing the possibility of dumping dollar reserves to protect them from seizure.

In “Is this the beginning of the end for the US Dollar,” the author speculates that

the US appears to be losing the biggest point of leverage it has over world affairs. If the US dollar becomes just one currency among others, its status as a global superpower will be under threat.

To bring this back to politics here at home, the one thing most people seem to agree upon, according to the research that I’ve done, is that the key to remaining the world’s reserve currency is to ensure we remain a “safe haven.” So it leads me to the conclusion that the more unstable we are at home, the less we will be seen as a safe haven to the rest of the world.

Debt crisis

Here’s an interesting read from Ray Dalio on navigating the debt crisis. In this short memo he states something very interesting:

When debt assets and liabilities become too large relative to incomes and debt burdens have to be reduced, there are four types of levers that policy makers can pull to reduce the debt burdens:

austerity (i.e., spending less),

debt defaults/restructurings,

the central bank “printing money” and making purchases (or providing guarantees), and

transfers of money and credit from those who have more than they need to those who have less.

Policy makers typically try austerity first because that’s the obvious thing to do and it’s natural to want to let those who got themselves and others into trouble bear the costs. This is a big mistake. Austerity doesn’t bring debt and income back into balance because one person’s debts are another person’s assets so cutting debts cuts investors’ assets and makes them “poorer” and one person’s spending is another person’s income so cutting spending cuts incomes. For that reason cuts in debts and spending cause a commensurate cut in net worths and incomes, which is very painful. Also, as the economy contracts, government revenues typically fall at the same time as demands on the government increase, which leads deficits to increase. Seeking to be fiscally responsible at this point, governments tend to raise taxes which is also a mistake because it further squeezes people and companies. More simply said, when there is spending that’s greater than revenues and liquid liabilities that are greater than liquid assets, that produces the need to borrow and sell debt assets, which, if there’s not enough demand for, will produce one kind of crisis (e.g., deflationary) or another (e.g., inflationary).

Through that lens, my only conclusion is that I am entirely ill equipped to proffer any rational solutions. It’s simply way above my level of comprehension. So I welcome any and all thoughts on this important subject because I find myself struggling to see how we can dig our way out of the financial hole short of — dare I say it — World War III.

I guess to state the obvious, we need to bring financial accountability to Washington. Given the irresponsible politicization of the debt ceiling, let’s harken back to July 2011. Opinions about what should be done were sought from various quarters as news organizations struggled to keep up with the battle waging in Congress and behind closed doors.

Holding politicians fiscally accountable and responsible

Warren Buffett waded in with his opinion on the debt ceiling in a July 7, 2011, CNBC interview conducted by Becky Quick.

You just pass a law that says that any time there's a deficit of more than 3 percent of GDP, all sitting members of Congress are ineligible for re-election. Yeah. Yeah. Now you've got the incentives in the right place, right? So it's capable of being done.

That would certainly do it! Sadly, the only way to enact Buffett's idea without the cooperation of Congress would be a constitutional amendment. A proposed amendment would then need to be ratified by the legislatures of three-quarters of the states. If that happens, and it is a very, very big if, Buffett's deficit plan would become the law of the land. That process would, however, take more than five minutes.

Regardless, it’s become clear to me that there is no fiscal accountability on either side of the aisle so hanging onto the GOP because of a belief that Republicans are more fiscally responsible is an unreasonable conclusion.

Let's hope that we can make an impact and change course before it's too late.

Evolving capitalism

My premise throughout this project is that fairness matters. That anything in the extreme has negative consequences, both intended and unintended. Along those lines, unbridled capitalism comes at a cost. Our country is an ecosystem and the entire idea of an investor class competing against a working class is a recipe for social unrest and institutionalized unfairness.

I strongly believe that the health of our society should matter to the investor class and we must evolve capitalism beyond a single bottom line! We need to improve capitalism to be far more nuanced and able to have an objective beyond creating shareholder value. Innovation is critical to every business so why shouldn't that apply to the framework of business itself?

But perhaps the tide is turning. Enter “conscious capitalism” and ESG.

Conscious capitalism

The conscious capitalism credo acknowledges that while free-market capitalism is the most powerful system for social cooperation and human progress, people can aspire to achieve more. It does not minimize profit-seeking but encourages the assimilation of all common interests into the company's business plan. The tenets of conscious capitalism can guide business owners toward an enhanced way of doing business that benefits all stakeholders in a socially responsible manner. The main purpose of building a business is to generate profits, which enable business owners to pay their employees. In turn, this allows the owners and employees to support themselves and their families.

Conscious capitalism does not dismiss the importance of generating profits for businesses. Rather, it enhances this purpose by complementing it. Conscious capitalism is a philosophy of doing business in a way that combines the generation of profits with socially responsible choices. The tenets of conscious capitalism recognize that a business has many stakeholders — individuals or entities involved in, affected by or holding an interest in the business’s activities. These stakeholders include the company’s employees, shareholders, surrounding community and even the environment. The founders of conscious capitalism were Whole Foods co-founder John Mackey and marketing professor Raj Sisodia. They established four main principles or tenets of conscious capitalism. These tenets are as follows:

Higher purpose. Businesses run by conscious capitalists exist for a greater purpose than mere profitability. Profits are necessary for the success of a business, but only as a means to an end. They can assist in a company’s mission to achieve its greater social goals, but cannot serve as the ultimate goal of a business.

Stakeholder orientation. Conscious capitalists are focused on creating win-win scenarios. Businesses are viewed as dynamic ecosystems made up of employees, customers, suppliers, investors, competitors, society and the environment. Just as in nature, for an ecosystem to thrive every element must be nurtured. Conscious businesses recognize the value of this ecosystem and foster positive outcomes for all stakeholders involved in their operations.

Conscious leadership. Leaders are integral to the success of the conscious capitalist system. For the system to flourish, leaders must seek to benefit the collective rather than themselves. Conscious leaders inspire their cohorts, stay focused on the higher purpose, and support the diverse ecosystem in which they exist. Culture is at the core of a conscious capitalist system, and great leaders set the tone.

Conscious culture. Culture is the heartbeat of any successful institution, embodying the values and principles that drive behavior. The conscious capitalist culture is grounded in love, care and trust. Employees demonstrate honesty, loyalty, fairness and are open to personal growth. To the conscious capitalist, how business is done is just as important as what business is done.

Conscious capitalism sounds great in theory, but does it actually deliver positive results? Brands like The Container Store, Trader Joe’s, and Starbucks seem to think so.

Environment, social and governance

Another important transformation is happening in the realm of conscious capitalism: ESG investing. In fact, the financial performance of ESG stocks has recently drawn a lot of attention. During the market turbulence related to the COVID-19 pandemic, many companies with strong ESG track records showed lower volatility than their non-ESG counterparts. To many investors, that performance validated ESG investing and its premise — that good corporate behavior means better business results. ESG investing goes beyond a three-letter acronym to address how a company serves all its stakeholders: workers, communities, customers, shareholders and the environment.

If you’re unaware, ESG stand for:

Environment. What kind of impact does a company have on the environment? This can include a company’s carbon footprint, toxic chemicals involved in its manufacturing processes and sustainability efforts that make up its supply chain.

Social. How does the company improve its social impact, both within the company and in the broader community? Social factors include everything from LGBTQ+ equality, racial diversity in both the executive suite and staff overall, and inclusion programs and hiring practices. It even looks at how a company advocates for social good in the wider world, beyond its limited sphere of business.

Governance. How does the company’s board and management drive positive change? Governance includes everything from open proxies, issues surrounding executive pay to diversity in leadership, separation of the CEO and chairman roles, as well as how well that leadership responds to and interacts with shareholders.

Whether you believe in conscious capitalism or ESG, I am trying to make the case that we need to move beyond a single bottom line. If we don’t evolve, we die. That concept applies equally to capitalism itself, And, it is beyond appropriate in a political context as well!

Just musing, but perhaps my view is that the current incarnation of the Democratic Party is more “conscious” than the GOP’s preference for a shareholder-first mentality.

Here is an interesting development. Could you have ever imagined a group of conservative policymakers would break from the GOP's economic agenda and embrace a more "liberal" approach to economic policy? Well ... There was a policy manifesto published by American Compass called “Rebuilding American Capitalism: A Handbook for Conservative Policymakers.” It notes that small group of Republican politicians have become more comfortable using government power to regulate the economy. Consider this:

Sen. J.D. Vance, the Ohio Republican, and Sen. Elizabeth Warren, the Massachusetts progressive, have collaborated on a bill to claw back executive pay at failed banks. The two worked through the details through in-person conversations, weekend phone calls and late-night texts.

Sen. Marco Rubio, a Florida Republican, has signed a public letter calling for the reinvigoration of collective bargaining and praising the German approach, in which labor unions play a larger role in the economy. Rubio a book, “Decades of Decadence,” that criticizes the past 30 years of globalization.

Sen. Todd Young, an Indiana Republican, has helped write a bipartisan bill to restrict noncompete agreements, which companies use to prevent their employees from leaving for jobs at a competitor.

Sen. Tom Cotton, an Arkansas Republican, was among a bipartisan group of lawmakers who began pushing a few years ago for federal subsidies to expand domestic semiconductor manufacturing. President Biden signed a version of the policy last year.

So what's the counter-argument?

In "How 'ESG' came to mean everything and nothing," the BBC posits the following question:

"ESG" was supposed to be a clear way for companies to explain their business decisions around environmental, social and governance considerations. How did the term go off the rails?

Let's look at how one-time GOP presidential candidate Vivek Ramaswamy, author of “Woke, Inc.: Inside Corporate America’s Social Justice Scam,” framed the issue of ESG during an interview with Samantha Aschieris of the Daily Signal:

ESG refers to the use of dollars—including your dollars—to advance environmental or social goals, in addition to what they’ll call governance goals, that are not implemented through public policymaking, through elections, or through democracy. Rather, they are implemented through the economy instead, largely by buying shares in companies and then forcing those companies to behave in a certain way. That’s what it is.

And what the ESG movement really represents is that old worldview rearing its head again in modern clothing, saying that citizens cannot be trusted to deal with questions like societal inequity or climate change or whatever the hot issue of the day may be, that those issues have to be settled by someone sitting in a different backroom. It’s a backroom corner office on Park Avenue instead of the backroom of a palace in the Old World, European way.

While his framing of the issue is certainly worth considering, I think the only real substantive — and very valid — point that he makes is that any company pursuing an ESG or conscious capitalism agenda should be required to be fully transparent and disclose their investment policies so that shareholders can make an informed decision and "vote with their wallets." Fair enough.

But beyond that, I do not believe that every issue we face as a society should be addressed by politicians, whether in Washington or in our local town. In fact, as we've discussed throughout Fairness Matters, this is likely the worst time to advocate for, or rely upon, our political process to solve the problems we face given how poorly the system represents the majority's view on most issues.

Perhaps if we were able to implement the political reform that I am advocating, then some of the need for conscious capitalism might dissipate. But, I do find it ironic that Ramaswamy campaigned as a Republican arguing against the free market economy and for larger government.

It's also laughable that he is vilifying corporate America after Trump pulled out of the Paris climate accords and “supercharged this movement." While it's true it was a catalyst, it is Trump's actions that should have been vilified. If Ramaswamy sincerely believed his own platform, then he would acknowledge when a president takes an action that 52% of American's said will hurt the economy and 64% say they disapprove of his handling of climate change. That alone is enough to undermine the credibility of Ramaswamy’s arguments.

It's also unfortunate (and partisan) that he frames these issues as "one-sided political agendas." That framing should offend everyone who reads it. The issues that we face, from structural racism to climate change to equal opportunity, are not "one-sided political issues" — they are our responsibility as a society and we should be encouraged to solve them on our own, without government interference.

I would think that most conservatives would agree with me on this issue. Most true conservatives would not want to empower the government to solve our problems and would prefer to rely upon the free market, which, by definition, includes the freedom and ability for corporations and businesses to make decisions on how they invest their capital, unfettered by government interference — especially in today's environment when politicians can't be trusted to implement common sense policies.

Let's view this issue through a different lens. Let's look at Ralph Nader and his infamous "Nader's Raiders," who, during the 1960s and 1970s, were the "driving force behind the passage of more than two dozen landmark consumer protection laws." There is little doubt that those laws, and the bureaucratic agencies that proliferated as a result, have contributed to the "deep state" that any good libertarian would loath. But viewed differently, any common sense person should conclude that, in reality, it was corporate America's blind pursuit of profits that caused the proliferation of the very agencies that the GOP is so anxious to eviscerate.

I hope we can strive to do better.